Where in the UK buys the most gold?

Gold has long been a symbol of wealth and a trusted investment in times of uncertainty. The demand for gold spans generations and geographies, from gold bars to jewellery. But have you ever wondered which parts of the UK are driving this demand?

Using internal data, we’ve uncovered fascinating insights into the regions and cities that comprise the highest percentage of our revenue and total orders.

So, whether you’re curious about which areas buy gold the most or want to see how your area compares, join us as we dig into the numbers and unveil the UK’s biggest gold buyers.

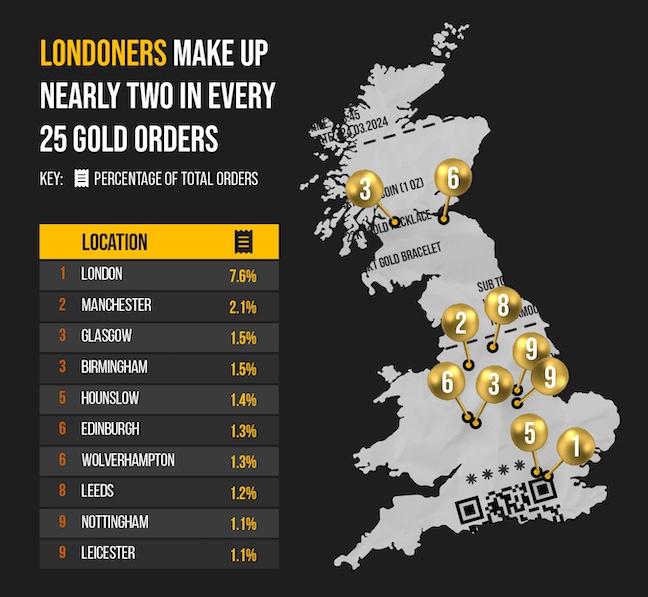

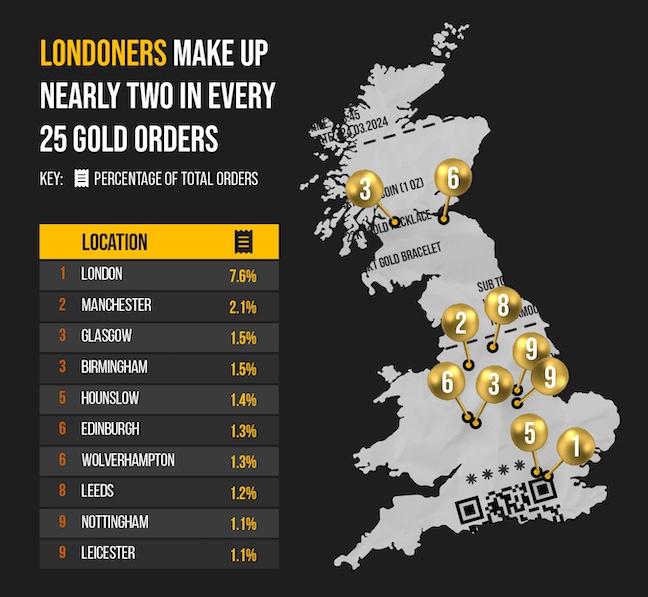

Londoners make up nearly two in every 25 gold orders

-

London - 7.6% of total orders

London accounted for almost two in every 25 (7.6%) orders over the past year — reflecting the capital’s strong connection to wealth and investment. Political events such as the election of a new Prime Minister and President occurred in 2024, suggesting that people in the English capital are most interested in protecting their wealth against fluctuations.

-

Manchester - 2.1% of total orders

Manchester takes the second spot, responsible for more than one in 50 (2.1%) of orders. From its industrial roots to its emergence as a vibrant financial centre, Manchester’s figures show the appeal of gold as a safeguard against inflation and global economic challenges.

-

Glasgow - 1.5% of total orders

Glasgow ranks third, contributing 1.5% of total orders. As discussions around Scotland's potential independence occasionally resurface, concerns about the future of the currency may encourage Scots to diversify their assets. Gold, a global store of value independent of any single currency, could provide Glaswegians with reassurance and stability.

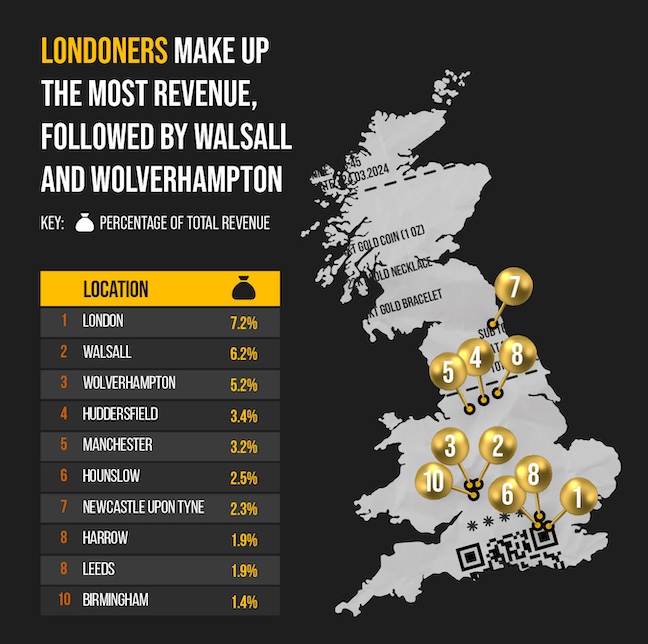

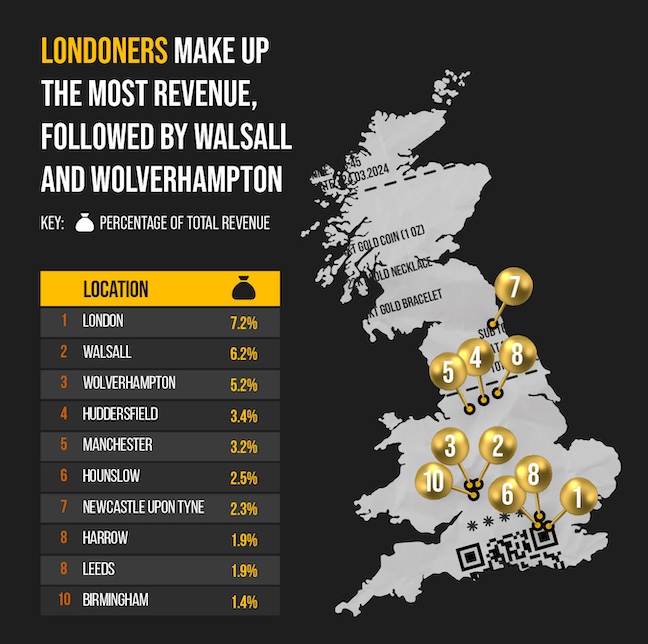

Londoners make up the most revenue, followed by Walsall and Wolverhampton

-

London - 7.2% of total revenue

As people in the city placed the highest proportion of orders, it may be no surprise that London makes up over 7% of the total revenue. Whether stored as coins or bars, this tangible asset offers Londoners a trusted way to preserve and grow their wealth.

-

Walsall - 6.2% of total revenue

Walsall might not be the first place that springs to mind when thinking of gold, but this industrious town has emerged as a major player, contributing 6.2% of revenue in 2024. People in the town were responsible for just over 1% of total orders, showing that they tend to make high-value purchases when they place an order.

-

Wolverhampton - 5.2% of total revenue

Wolverhampton, a city steeped in history and innovation, takes a well-earned third place, accounting for 5.2% of revenue. However, customers from Wolverhampton only made up 1.3% of the total orders, indicating that while there may have been fewer, they were higher in value than locations such as Edinburgh, Hounslow, and Birmingham.

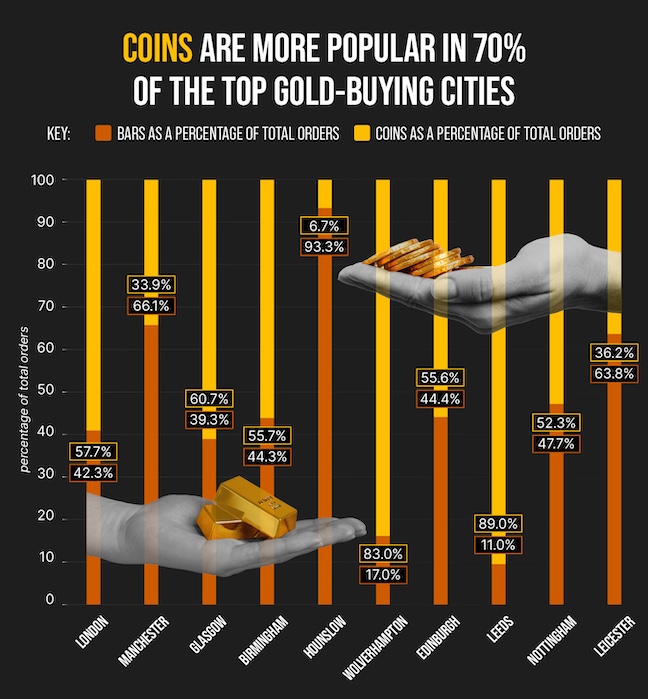

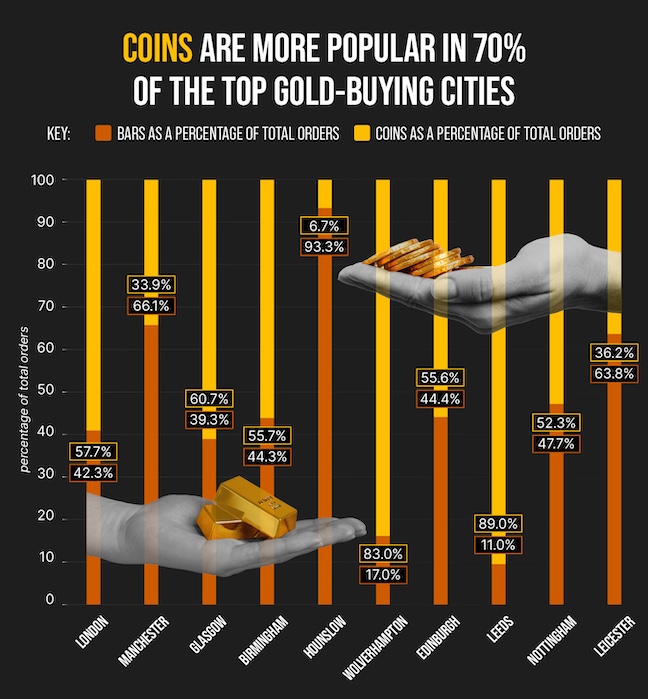

Coins are more popular in 70% of the top gold-buying cities

There is a preference for gold bars in Hounslow, with more than nine in 10 (93.3%) of customers choosing these. In contrast, Leeds tells a completely different story, with coins accounting for 89% of orders.

Cities like Manchester and Leicester also lean heavily toward bars, with 66.1% and 63.8% of orders, respectively. On the other hand, Wolverhampton (83% coins) and Glasgow (60.7% coins) suggest an enthusiasm for coins.

Interestingly, London, the financial hub of the UK, has a more balanced split, with 42.3% bars and 57.7% coins. This balance may be down to the city's diverse clientele, with investors looking for variety in their portfolios.

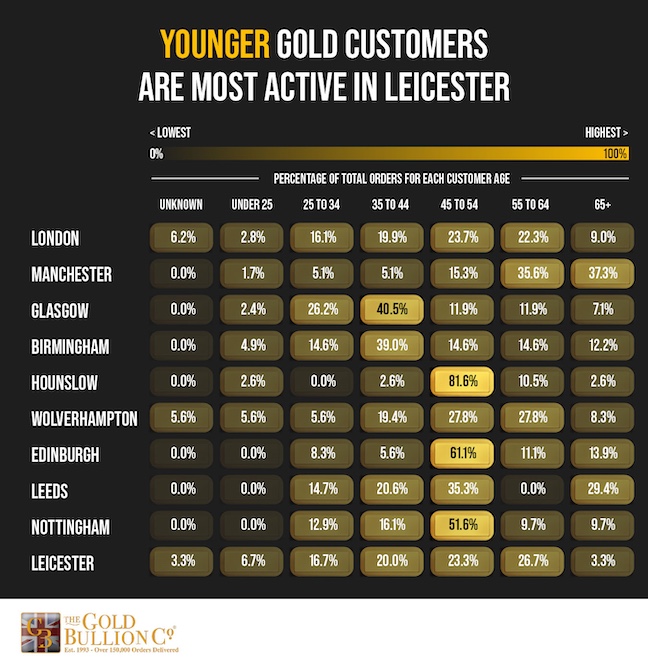

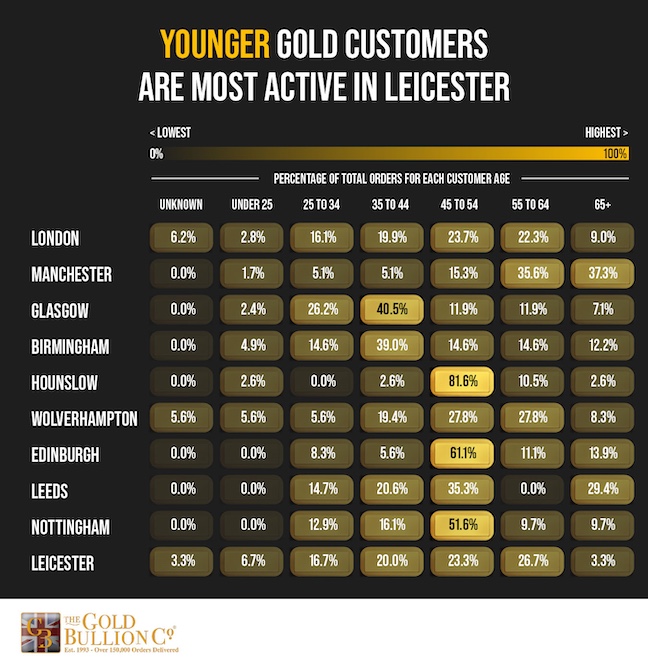

Younger gold customers are most active in Leicester

Younger buyers (under 35) are also prominent in cities like Glasgow and Birmingham, where they represent 28.6% and 19.5% of orders, respectively. However, Glasgow stands out for its concentration of buyers in the 35–44 age group (40.5%), which may show an appetite for gold among mid-career professionals.

Older customers account for the highest percentage of orders in a few cities, with those aged 65 and over representing the majority of buyers in Manchester — this age group accounts for almost two-fifths (37.3%) of all orders.

Over four in five (81.6%) orders in Hounslow come from the 45–54 age bracket, while only 5.2% are made by people aged 44 and below.

Why is gold investment popular?

Gold has been the go-to investment for centuries, and it’s easy to see why people buy gold. The timeless reliability is why gold remains a favourite for those wanting to protect their wealth, no matter what’s happening in the economy.

It’s like a steady friend you can always count on. When currencies take a hit, gold often holds its ground or can even climb higher. This is particularly true when the US dollar, the heavyweight of global trading currencies, starts to wobble.

That reliability is why financial advisors often recommend giving your portfolio a solid foundation of gold to weather any storms.

And then there are the perks! In the UK, some gold coins, like the Gold Britannia and Sovereign, come with the bonus of being Capital Gains Tax-free. That means you won’t be handing over a chunk of your profits when it’s time to sell. Plus, gold is surprisingly portable — easy to store, simple to transport, and even welcome across borders.

Methodology

We used The Gold Bullion internal data to find the percentage of total orders and revenue that different locations were responsible for over the last 12 months. This data was then broken down by age of customer and the type of gold product they bought.

Data was collected in December 2024 and is correct as of then.