How to Buy Gold

This guide on how to buy gold will help explain to you the basics of buying and selling gold. We will look at gold in its different forms, investment strategies, the history of gold, the trends and patterns used to attempt to predict the price and the variables that influence the fluctuations in the spot price of gold. Whether you are looking to learn more about the gold market because you wish to make an investment or you simply have an interest in the historical or current market, this guide should help clear up the terminology and provide a basic understanding of how the price of gold works. If you are looking to purchase gold, read through this guide on how to buy gold bullion, to find out everything that you need to know.

1 Introduction to Gold Price

1.1 Buying and Selling Gold – The Basics

Gold is a precious metal, it is one of the densest metals with astonishing weight (one cubic meter weighs 19,300kg.) It is a yellow coloured precious metal with the chemical element Au (atomic number 79).

Due to gold’s high indestructibility, the majority of gold that has ever been mined is still in circulation today. It has been estimated that as of the end of last year that approximately 190,000 tonnes of above-ground gold stocks are in existence. Gold can be melted very easily thus meaning it can be refined and reused. This, therefore, means that recycled gold also has an impact on the dynamics of the world's gold supply. It has been estimated that recycled gold makes up approximately 30% of the total global supply, leaving approximately 70% from mined gold. The largest producer of gold is currently China, which provides 12% of the total, of which Asia as a region accounts for 19% of newly mined gold.

The price of gold is an interesting topic as it is constantly fluctuating, and many people invest in gold as it has retained its value for many years. People will decide to buy gold for many different reasons. Whether you are an experienced investor, are purchasing gold as a gift or want to learn about gold prices on a hobby basis. It is said to be a good strategy if you want to protect your wealth against depreciation, inflation and currency fluctuations because gold price per gram has historically maintained a high value (although the value will drop during price troughs). This has led to it traditionally being considered as a low-risk strategy for investing. Gold is a potential investment option if you are looking for long term financial growth but it is also possible to make money buying and selling gold with a much more short term strategy. It is important to note though, that no strategy carries zero risk as there is always the chance of gold losing its value and the current gold price per ounce could drop.

There are several different methods to buy and sell your gold including from bullion dealers, cash for gold outlets and online companies. When you buy gold in person or online you should be provided with a sales receipt as proof of purchase when you wish to sell your gold on. Some people provide a certificate, but these are less common now due to fraud. The most commonly purchased types of gold are in the form of coins and bars and we will discover why this is later on.

There is a lot of confusing terminology when it comes to investing in gold so we are going to break down the terms and make getting the best price for gold a much easier task. If you are planning to invest it is better to be well informed before you begin as with any investment there are risks and things you need to know.

1.2 Units

Ounce or troy ounce is the standard, universally recognised weight for discussing the price of gold. Since the 16th century we have been using the troy ounce as a measurement, it later became the official coinage unit of weight. The gold ounce price is always used for quoting what’s the price of gold and the spot price is recorded this way too. Even though we use the metric system in England quoting gold prices in grams is much less common, but you can have the prices converted into ‘gold price in grams’ or buy in a multitude of measurements online. One ounce of gold is equivalent to 31.1035 grams if you wish to convert this yourself.

The gold price oz is also quoted in dollars (dollars per ounce). The dollar was historically seen as the international currency and even today it is considered the safest currency. Using these units to discuss price standardises the commodity being sold. Thus, making trading more universal which thereby increases the amount of trade. Using different units would slow down the process and with prices changing by the second, there is little time for conversion during trading hours.

2 Gold in its Different Forms

2.1 Carat

When people refer to ‘carat’ this is a measure of the purity of the gold. With other materials such as pearls it can be used as a unit of weight, but Troy ounce is the unit of weight used for gold. The purity of gold is expressed in fractions of 24 with 24 being the purest form. 24ct is the softest form of gold and is also referred to and marked as four nines which may be written as 999.9 (parts per thousand). This also makes it the most valuable form of gold with 24-carat gold price being the most expensive when it comes to purchasing. 24k gold price is what most investors will be watching because bullion products are usually 24 carat, but some websites will provide prices for carats lower than 24.

Gold is available in a range of different carats, as the purity decreases, the carat drops. 18k gold price is still high but not enough really for investment and trading purposes. 18 carat means this gold has 18 parts of pure gold, hence it is 75% pure. It will be more difficult to get hold of 18k gold price per gram because less pure gold is of less interest to investors so if you have some gold you wish to sell and need say a 14k gold price per gram then you may need an independent valuation.

Gold is made less pure when it is combined with other materials. Most commonly these are alloys of copper or silver which do increase the durability of the material. As 24k gold is so soft it is less practical and not strong enough to be used as décor, jewellery or orthodontic appliances. However, when it comes to what price is gold in terms of carat then the purer the better as 24k gold price is the highest.

2.2 Gold Jewellery

If you are looking to buy or sell jewellery then you are more than likely looking for the 9ct gold price. This is the most popular type of gold and the majority of jewellery in the UK is made out of 9ct which only contains 37.5% of the precious metal. Unfortunately, this is not used for investment gold because its purity value is so low. However, it is one of the most popular for selling on in cash for gold outlets if you need to have some money fast.

Asian gold jewellery is typically made from gold of a higher purity, often 21 or 22ct. If you are looking to sell some Asian jewellery, then you will probably need to look for the 22k gold price. This jewellery appears a more yellow colour than normal jewellery as it is 91.6% gold and is also combined with silver in it. However, it is very important to check the hallmark of your jewellery to verify the carat of the material to obtain an accurate estimate for your ounce of gold price.

Although it may be more impressive to look at and more interesting to invest in, sadly jewellery is not used for investment. Investment gold must be 99.5% pure gold to be able to compete in the trading market for a good value.

Jewellery accounts for two-thirds of annual gold demand and India are responsible for around 27% of that, which makes them the highest importer of gold jewellery in the world. This is largely down to Indian culture, where buying gold as a gift for weddings is extremely popular. The large gold demand in India actually became a concern for the government as they do not produce gold, so need to import it all in large quantities. Gold nearly accounts for 12% of Indian imports, which causes issues with the value of their currency.

This weakens the currency due to the large amounts of Rupees needing to be sold to buy gold in dollars. This, therefore, means that other imports such as oil are made more expensive to buy. The Indian government also see it as an inefficient return of Indian savings as gold does not give an economic return to the Indian economy. To reduce the demand for gold in India, they have increased the import duty in the hope that people will invest their money in more economically efficient means such as shares and bonds. This will all have an impact on the price of gold all over the world as it can have a material effect on demand. China is also a large player when it comes to the demand for gold. Gold is also steeped in the culture of China, but it is only recently that China has become so affluent with much of the population striving to become middle class.

This has meant that more people are now able to buy gold and due to the vast size of China, it has had a severe impact on the levels of demand. With the Chinese economy beginning to slow down recently and the possibility of a large debt crisis looming over the country, it is unknown whether the current levels of wealth rises will continue, therefore impacting the demand for gold. It is estimated that by the end of 2020, India and China, the world’s biggest gold demanding countries will have a combined increase of one billion new urban consumers, further affecting the demand for gold.

If you are looking to sell on gold jewellery with stones in this should not affect the price you get for your gold. The stones in themselves may be worth something but if you are selling the gold as scrap gold then the stones are removed, and the gold is melted down and refined.

2.3 Gold Coins

Gold coins have a little more character than trading the stereotypical bars of gold so may be ideal for those investing as a hobby or looking for initial smaller investments. Gold coins are not only used for investment but are also popular for gifts and memorabilia. There are a variety of coins available and collectors also play a large part in the trading of coins. Knowing the gold coin price can be very important if you are looking to sell a collection because a lot of people often underestimate their worth. However, when it comes to the price of gold coins, not all coins are worth a lot as they are again made from different purities of gold so looking at a gold price graph today may not be overly accurate.

A typical bullion coin should contain one pure ounce of fine gold as either 22 or 24 carat and these are the coins used in investing. You can buy a range of different types of coins and the three most popular ones are the Royal Mint Britannia which is 24-carat gold, the South African 1 oz Krugerrand which is 22 carat and the Canadian Gold Maple which again is 24 carat. The coins with the highest carat carry the most value. The coins made by The Royal Canadian Mint are the finest gold coins in production and have been classified as 999.9. Coins are purchasable in different sizes and weights, produced in different years and different rarities.

UK coins, including gold sovereigns, half sovereigns and gold Britannia coins are Capital Gains Tax Free which makes them an appealing mid to long term investment option. This means that when you sell these coins on you will not be taxed on your profits which cannot be said for other materials such as silver. Profit is tax free on coins of the realm but all other profits over £12,000 a year are taxed.

2.4 White Gold

White gold has a more silver colour to it as the gold has been combined with a metal such as platinum or nickel. White gold will fetch much less in price compared to pure gold, so it is not commonly used in investing due to it not being in bullion form. However, you will still get a price dependent on its gold content, this is where white gold differs to the price of gold and silver. The valuation also depends on what the gold price is today. If you want a white gold price per gram these are available online. So, if you are thinking of selling white gold jewellery or purchasing, for example, a wedding ring, higher carats are available and can still be worth a lot of money. The main use of white gold again is in jewellery especially with ‘yellow’ gold jewellery becoming less popular in the UK in recent years due to the increased demand for white gold and rose gold jewellery.

You are most likely to sell a white gold ring to a gold dealer or by auctioning it online. Vintage pieces will sell for more money in auctions because of the high demand for this style. Dealers will usually then sell the jewellery on to be refined to extract the pure gold.

2.5 Silver

It is not just gold that investors are buying and selling, there is also a large market for silver bullion. Silver may be considered a more risky strategy even though gold and silver prices are closely linked, and both fluctuate daily, silver is known for making larger movements. Watching gold and silver prices live can be very interesting and also stressful for someone looking to invest in both markets. Gold and silver prices today are not the same as they have been historically because demand and supply have changed over time. If you are interested in investing in both then increases in gold and silver prices are both capable of making a profit if you buy and sell at the best times according to the daily price chart of gold and silver.

As an investor, you may want to keep an eye on both gold price and silver price charts and movements as they can often be affected by the same events such as economic events and government announcements. However, it is important to bear in mind that silver is also less popular for investing because you have to pay VAT when buying and selling so your profit may not be as large as it appears.

2.6 The Bullion

The term bullion refers to either gold or silver in its bulk form as a bar before it is changed into another form or valued. The spot price of gold chart is based on the bullion, which is pure gold; the price then decreases as the purity decreases. These charts show the gold bullion price every few seconds so people buying and selling bullion can do so when the gold price is at an optimal level. The bullion is used for investments mainly, people wanting to invest larger amounts of money will buy gold in the form of a bar. Jewellery, even 24 carat does not count as bullion. There are different types of bars available including Umicore, Emirates, Perth Mint and Metalor. These bullion gold bars are VAT free and some coins are also free from capital gains tax.

A bullion bar should be 99.5 percent pure fine gold and should possess a purity stamp. However, The American Eagle, Krugerrand and Britannia are only 22 carat, but they have additional weight in alloy to harden their wear. The gold bullion price is the daily price of gold bullion bars that fluctuates constantly and investors keep track of. The main reason people would want to know what the daily gold price is when they are wanting to buy or sell bullion and are looking for the highest and lowest prices.

Both silver and gold prices are available for bullion on a real gold price chart or silver chart. However, the price of gold rate can be different for coins, some are less expensive depending on their carat or make so you might need to find the price for your specific coin if you are looking to sell. Also, consider that some coins are not tax free so selling them will mean that you will not get the full stock price of gold per ounce selling price.

2.7 Scrap Gold

If you are not looking to invest but have some old jewellery, coins or other unwanted precious metal items then these can be sold off as scrap gold. Gold scrap price will vary between buyers and is greatly dependent on the weight and carat, so it is useful to shop around. It has a different value to other gold because it will need restoring to an original form especially in cases such as broken jewellery so you will not get scrap gold prices today anywhere near the live gold price or the gold bullion prices. This explains again why scrap gold is not used for investing but there is potential to make a profit from selling off old broken jewellery that you would usually have disposed of. You can be quoted for scrap gold price per gram online if you know the quantity you wish to sell but again this will be nowhere near the current price of gold per ounce. The scrap gold price does fluctuate in the same fashion as gold price, but you will get a lower value because the dealers will need to pay to get the gold refined and converted back into its original form.

3 Investment Options

3.1 Investing as a Hobby

For people interested in economics, world news, stocks and shares and investing, observing how much is the gold price can become a hobby (that could also make you some money). This makes a great hobby for many people whether it is after retirement, during maternity or to do weekends and evenings when you have a little free time to check the news price of gold. You get the thrill of watching the markets and investing whilst knowing you have a relatively safe investment that you will not lose money on if you don’t sell as the price drops. You can monitor your investment as frequently or infrequently as you want to by looking at the gold price news now, with our live spot price of gold and gold price charts.

For example, our average gold bullion order size is £1700 so say you invested £2000 and the prices can fluctuate 5% over a month there is potential to make £100 from such an investment. If you get the best gold prices you can make money and keep reinvesting your profit and the more gold you buy the more scope, there is to make money if you keep checking is the price of gold up today. If you start with 1 ounce and watch the 1 oz gold price until it is at its highest then sell it on you will be able to buy a larger quantity next time or repeat the same and cash in any profit made.

For those people who are less interested in the profit made or want to invest a smaller initial amount of money they may find investing in silver more exciting as the value tends to fluctuate more. However, before you decide on your investment have a look at the price for gold and silver today and evaluate your options.

3.2 Long-term Investment Strategy

There are no guarantees of an investment strategy that provides returns or holds its value without downside risk. However, over time gold has more or less maintained its value, even during downturns in the economy. This tends to be the case because investors see gold as a “Safe Haven” asset, which means that it’s perceived to be one of the safest assets available, which therefore means demand for it increases when there is turmoil in the markets. Whether it truly is a safer asset or not, is less important now because it is widely believed in the markets that it is. This means that because of herd behaviour, demand will generally always increase in market turmoil. You can then also add in the effect of speculators who recognise this reaction to market turmoil and buy gold to make a profit on the increased demand, which magnifies it further. Gold can therefore potentially provide you with a physical piece of wealth that is less affected by economic markets. Investing in gold is also partly seen by some as a safer asset because with gold you’ll always have something for your investment (a physical block of gold in a vault somewhere).

Gold price investing also has tax breaks whereas savings accounts and stocks and shares are all subject to tax. There is no added VAT on investment grade gold so you pay for only the value of the item, even when you cash them in the same applies regardless of how long you keep the investment.

You also have the possibility to make money from the price on gold via what is known as a ‘spread bet’. With a spread bet you do not have to actually buy any gold or have as much upfront money. You are able to bet on gold by predicting the price of gold in up or downwards movements. You make a profit for every point the gold moves in the direction you placed your bet. Because you are not outright spending your money on the physical gold you have more leverage meaning you can make bigger bets and earn more money in relation to the money you put up front. You will have to put a margin payment down to cover any severe movements in the price of gold, but this will be less than the cost of physically buying gold. Unlike when you buy gold outright, you are also able to make money via a drop in the price of gold, by betting that the price will go down. It is important to note here though that you could potentially lose much more money than the total risk of buying gold, because upward movements in gold are infinite, whereas on the downside gold can never have a negative value.

If you start off buying gold outright you will gain when gold prices increase and a higher price of gold in the market is what you are looking for if you wish to sell. However, it is important to consider that the value of your gold will drop when the price of gold price drops. It is therefore important to keep an eye on the selling price of gold. Although predicting where the price of gold is going to go next is extremely difficult, you can help your research and decision making by keeping a close eye on the price of gold latest news.

Even if you have invested in gold as a long term strategy then gold stock price and price for gold information is so readily available it is worth keeping updated in case of any particularly low prices to invest more or extremely high rates to maybe sell on some of your investment to be able to reinvest. If you want a long term investment it is important to keep up to date with financial news. Or simply just to know where your investment is at the moment which any serious investor would want to know.

3.3 The History of Gold - What Was the Price of Gold?

Copyright: monsitj

Gold price history is an interesting topic as people have been buying and trading with gold for many years. Gold has been used as a type of currency for centuries now and most governments still retain major gold investments. However, historically it was not in British culture to buy gold. We can look back as far to events such as WWII from 1939 to 1945 to see how these impacted the gold price per ounce history.

Since the gold prices, today per ounce have increased it has become a more popular investment strategy. In 2011 the gold selling price went up dramatically which provoked a media interest and investors quickly followed. As awareness became elevated so did the international gold price as more people were putting their money into gold as the demand boomed.

Looking at historical gold prices could potentially help you with any predictions regarding an investment in gold, as you’ll have a better understanding of trends in gold.

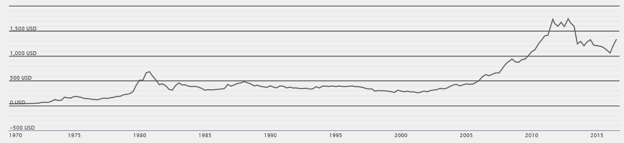

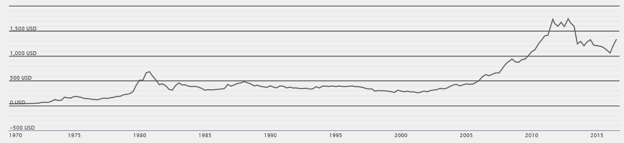

If you are looking at the historical price of gold from a hobbyist or interest perspective, then you may be interested to examine the gold bullion price history chart. Since the 70s there has been an impressive growth curve. During times of economic turmoil price accelerations have occurred rapidly. With prices as low as $40 per ounce in the 1970s, we’ve then had peaks of $1900. Even with lots of peaks and troughs throughout this time period, the price has seen a general long term upward trend. August 2011 saw the highest ever gold fix price at $1917.90 per troy ounce. There is even data of the gold price ounce when you research the history of gold prices as long ago as 1792. For the historians, this may be of great interest to be able to examine the progression of the value of gold from the 18th century to gold live price today.

Those who invested in gold before the huge increase in demand and popularity could have potentially made a huge profit on their investment. To put it into perspective in 1978 one ounce of gold was worth £110 and in 2013 it was worth £1072 which is an 875% increase so the long term strategy would definitely have paid off if they bought at the lower price. Although the true value of this investment in today’s money will be deteriorated by the effect of inflation.

From 1976 to 1980 IMF (international monetary fund) sold 50 million ounces of gold, this period in history is when people really became interested in investing in gold. From 1999 to 2000 14 million ounces were sold in two years and from 2009 to 2010 it was 13 million ounces. 175,000 tonnes of gold have been mined from around the world due to the hugely increased demand and investment interest.

Gold fix price was introduced in 1919 when 5 traders met in London on a daily basis to decide the price of gold for that day. This, in theory, has carried on to today’s markets but as of 2004, these meetings are held via conference call twice a day to provide a gold price in the UK during their trading hours. The fixed price ceased during WWII as the gold market in London was closed during this period as it was not safe enough to keep hosting the daily conferences so trading in gold became more difficult during this period and people were keeping their investments. In 1968 after the effects of the war on the economic market had settled, they introduced a second daily meeting in the afternoon to accommodate for the American markets and the time difference.

3.4 The Price of Gold Today

What is gold price today? The live gold price charts fluctuate constantly with the current live gold price changing every few seconds. The fluctuations are often very small, just a matter of pence. However, it is possible for the cost price of gold to fluctuate much greater than this in a day.

Trying to find gold prices online is very easy, there are many websites that will provide you with the latest gold price. The Gold Bullion Company have a live gold price chart that updates regularly throughout the day.

Our website will provide you with the price of silver and gold at today's silver and gold price rates.

A daily change can have a big effect on an investor’s value of their gold. For a £2000 investment, a 5% fluctuation has the potential to lose or to make £100. A fluctuation like this provides a chance to make a large profit however the fluctuations will go down as well as up. This is why it is important to check gold price today because it’s not just today it's every day that there will be a new set price for trades to occur. When you are looking to buy, and sell is when it is especially important to check the price of gold chart on a regular basis, so you don’t miss the optimum time to assist your investment.

3.5 Investing Today

You will first need to look at the gold price now as it is important to not rush into anything if the gold price per ounce today is in a trough. You can begin to grow your knowledge by looking at the world gold price today live, the gold price today per gram and gold market analyses. You can then look into different types of bars or coins to pick a product. If you want to invest a substantial amount of money it can be actually cheaper to invest in large gold bars. For example, 10 ounce bars can be purchased for a smaller fee over the spot price. You can buy online, in-store or over the phone from a bullion dealer when you have selected your product. You can then decide what to do with your gold as you can store it in a vault anywhere in the world and have it insured there. Your gold is then ready to be sold or kept as a long term investment.

4 Gold Price on a Global Scale

4.1 Worldwide Gold Prices

The gold industry is of worldwide interest with most countries having some money invested in gold or they make money from the mining and production process. As of recent years, China is the largest producer of gold and provides 12% of the total gold available with Asia as a whole providing 19% of newly mined gold. Africa is responsible for 23% of global output with 16% from Central and South America, 15% from North America and 14% from Eastern Europe,

There are many misconceptions when it comes to the world gold price. Different countries do not have their own gold price, the price of gold is a worldwide value that is influenced by markets worldwide. They ensure the price today gold will not vary significantly across the markets from country to country. The spot gold price is set in London twice a day and there is only one graph of the price of gold that applies to worldwide gold price, but this is available in different currencies. This fixing process is an agreement between people within the market so that trading on a specific day all happens at an agreed price. This means that the gold price in India today is the same as the London gold price.

However, if you are selling in other countries there may be differences in VAT to consider.

The gold industry is massive in Dubai and demand is very high. Airports in Dubai have lots of shops selling gold that is pure and tax-free. In Dubai it is becoming more of cultural value to spend large amounts of money on gold jewellery especially for weddings so buying it out there can be easier.

The effect of foreign exchange rates can greatly impact any profits or losses from investing in gold. This is less important if your home currency is US dollars, because if it were to be US dollars you would not have to exchange currencies to buy and sell gold. After all, this is the basic unit. It is important to note though that changes in exchange rates may affect demand for gold, because if the US dollar strengthens it will be more expensive to buy the equivalent dollars to pay for the gold, meaning there will be less demand. Non-dollar countries do have to factor in fx changes into the real profit/loss from gold investments because any profits may be outweighed by an adverse movement in their currency against the dollar to close off the trade.

The gold price in India does vary slightly across different cities because of local market factors. These include taxes, policies and availability. If you are planning to travel abroad and invest money into gold whilst you are there it is worth researching how much is the gold price in your destination not just in sterling.

India quotes their gold price in rupees so the conversion rates will, of course, affect your price so you need to check the exchange rates before buying. These may be favourable exchange rates making sure you get the most for your money, but this does mean keeping an eye on both the gold price latest and the exchange rates.

There are even worldwide factors that can actually indirectly influence the price of gold by increasing or decreasing its demand. Religious festivals can increase the demand for gold, so the Asian markets have a large influence on trading especially in India and China. If you are looking to sell, then these times of year may be good for increased prices. Chinese New Year is a great example of such an event falling in January or February so the prices may start to rise in January. These factors are known as seasonal factors, which may lead to seasonal trends.

4.2 Calculate the Price of Your Gold

To calculate the price of your gold you only need three things. You need the purity or carat of your gold, the total weight in ounces and the spot price. Some websites will offer to calculate you a price using other units such as grams and quote in different currencies. To make this very easy there are many gold price calculators available online just search for scrap gold UK calculator and you will have many available, for example:

These will tell you how much your gold is worth whether you are looking to sell or just want to keep in touch with the value of the gold you own. These prices will differ between suppliers and you may get a worse deal if you visit a cash for gold shop so it would be recommendable to look around before selling. Also buying and selling prices will vary so you may not obtain the same rate as the current gold price per gram that you find online for valuation. There can be a 4 or 5% difference in the live rate and the rate that you receive because of the constant movements and the buyer or seller rates.

4.3 Gold Price Live

LBMA sets the gold current price for the world in London twice a day where the members calculate the price based on several factors. There is one governing body that results in one single worldwide price. Having a fixed price allows transactions to occur throughout the day without the hassle of having to agree upon a price that changes every few seconds (the gold live price). Deciding on a gold trading price at which to do a large deal using purely the spot gold price live would be very challenging because of these fluctuations and would make trading much more complicated.

This information is readily available in a live gold price chart (some links are mentioned earlier). This chart plots the price of gold per ounce (or today gold price per gram) against time. To watch a gold price today live chart you can find them online to give you a feel for how rapidly and unpredictably the price movements occur. These gold price live charts are used by investors in the bullion industry on a regular basis.

4.4 Spot Gold Price

The price of gold spot price is the clinical term for the price you pay now for delivery now, it is the most up to date price to the second. The spot price is the price you will get for your gold in that exact moment. This value changes every few seconds during the hours of trade due to data collected about changes happening in trading in gold worldwide. This is where the term ‘spot’ comes from because everything is happening on the spot, there and then. Dealers use this to decide on the cost of their bars and coins, which can change throughout the day. This is the same as the live price which is the value that changes constantly.

The spot price for gold is able to detect very small changes in valuation. However, some people are now setting valuation limits where computers are instructed to sell. This means they do not require someone to sit and continually watch a gold price today graph and the computer is less likely to make an error and knows when gold price now exceeds a limit. When certain limits are broken, and the price is considered high, large companies such as hedge funds can program their computers to sell the vast amounts of gold they own. The value of gold then drops because so much is being sold so that they can buy it back at a lower price and they have an opportunity to make money from buying their own gold back.

Stop losses are a strategy that attempts to protect people's investments against losing too much money. This is done by setting up a stop loss which means if the price drops to a specific level where they start to lose money that the computer automatically cashes in their investment. The argument is that banks artificially drive the price of assets (gold, currencies, and stocks) to a low point that triggers these people’s stop losses, so they automatically have to sell, and the banks buy the asset cheaper than what the real value of it is, so they can make money when the price goes back up again.

Traders also use the term spot price gold because you can have other forms of gold prices for different payment and delivery options. You can have a future or forward price which is the price you agree to pay at a future date for example in three months’ time for an agreed amount which will not be affected by the live price of gold. The gold price per oz is secured on the day the deal is agreed but the product does not need to be delivered or paid until that date. This enables people to secure a price and reduce the risk of the price increasing or decreasing at a later date. This may be useful for companies wanting to secure a large deal or if people are concerned the rates are going to change but do not want to invest yet.

4.5 Gold Fix Price

The gold fix price is the benchmark price of gold used to determine the price of products sold across the world. This is different from the spot price of gold because it does not fluctuate throughout the day. It gets set twice a day at 10:30 am and 3 pm in London at the LBMA and these values then act as today’s price of gold. The afternoon meeting was introduced to account for US markets because of the time difference.

This price was introduced to enable trade deals and to counter the constantly changing rates. All trade deals for that day will be made at the agreed fixed price to save dispute and ensure deals can be made easily and in an extended time frame.

You may also come across what is called the ‘future’ price for gold. This is different to a spot price because you neither have payment or delivery of gold on the spot. With a future contract, you are agreeing with somebody else to trade a certain amount of gold at a given point in time for a specific price. For example, you may agree with a counterparty that on a specific day in February 2021 you will trade 400 troy ounces of gold and you agree for the price to be $1,844.00 per ounce. The delivery of the gold will not have to take place till February 2021, and the payment will not have to be made until then either. These contracts were first introduced as a hedging method for traders of gold to guarantee prices for a future date, which helped for planning purposes. Nowadays the majority of gold futures are being traded for speculative purposes. This is because the futures markets are reasonably liquid markets, which means that there are lots of buyers and sellers, making it easier to trade. The reason more buyers and sellers are attracted to the futures market is that the size of trades and delivery dates are standardised. The exchanges that gold futures are traded on also guarantee payments in the case of a counterparty default, therefore reducing the risk for trading on that market.

5 Predicting the Price of Gold

5.1 Variables Influencing the Price of Gold – Are we Able to Forecast?

For many years people have been attempting to predict the price of gold. However, there is still gambling and speculating occurring surrounding the price of gold increasing or decreasing.

There are a number of variables affecting the ability to gold price forecast which makes it challenging to appreciate and understand the markets fully. This is a challenge for hobbyist investors but taking an interest in gold price news today could help you to forecast.

Variables influencing the price of gold include economic world events, future news, US government announcements, growth figures, markets in other countries such as China and India and hedge fund managers. It is possible for people with large quantities of gold to manipulate the markets by buying and selling in large quantities which is the economic effect of change and causes drastic unexpected fluctuations. If a company were to sell a large amount of gold, then the value of gold would depreciate because there is a greater supply of gold available to buy. This means that the price drops and such companies are able to buy back their gold at a lower price for gold per gram to free up some money or to reinvest in more gold.

There are tools available to help you in any attempts to forecast the price of gold. Kitco is a website that has live interviews with experts and hedge funds on a daily basis to keep people up to date with any global news and tips on how the price may change. This website has price quotes, charts, market information, analysis commentaries and a forum. This tool is used on a daily basis by bullion dealers. People also use information such as the gold chart price, historic data and the Fibonacci waves to identify a gold price trend. The Daily Telegraph also provide expert financial analysis in their financial reports, this could be useful to look at for those who are more serious about keeping a check on the value of their investments.

Monitoring the market is an important part of observing the trends and getting a feel for how the markets work to enable you to anticipate the gold future price. You can do this on several different websites where you can access a gold chart price daily in combination with historic data and gold price news.

There are other more general trends that can be observed throughout the year which can suggest better and worse times to look into buying and selling but these are not guaranteed as other factors will come into play. For example, the markets tend to slow down a little over the summer with many investors taking holidays. They are known to pick up more towards the end of the year as can be seen on gold chart price. Also, during times of celebration such as Chinese New Year and other religious festivals, the demand for gold may increase which could see an increase in the price too. During times of economic uncertainty and when stocks, shares and savings rates have taken a hit from the economy, the value of gold has historically increased. However, the rapid fluctuations that occur to the second cannot be predicted by such large trends, so it is important to still look at the gold spot price now to get the most current gold price on a gold spot price graph when you are looking to buy and sell.

Traditionally in most commodities, the real supply and demand of the commodity have a large impact on the price. For example, construction in China has slowed down, which has notably reduced the price of steel as there is less demand for it. This effect is not as prevalent in gold because it has become so ingrained that gold is more of an investment asset rather than just a commodity. Interest rates have become a large factor affecting the price of gold in recent times because of this. This is because gold can be considered as an alternative safe asset to invest the money instead of government bonds. We are currently going through a long period of uncharacteristically low-interest rates, which means that the return on government bonds is now very low. This low return on government bonds makes the substitute investment of gold, therefore, look more attractive as a result. We, therefore, find that if interest rates remain low, the demand for gold will stay higher, which increases the price. This also works in the opposite direction. If the Federal Reserve chose to increase their interest rate greater than the market expected at their next meeting, then it would logically be expected that the demand for gold will reduce, as its substitute has become the more attractive investment option.

5.2 Gold Price Graph

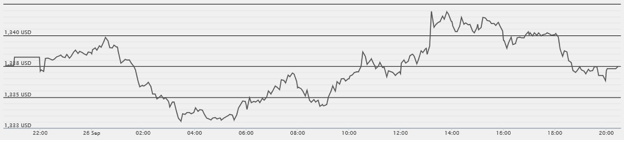

Here we have the long term gold price trend graph which shows the movement in gold prices since 1970. We can see that gold has gone through different stages in its history. Between 1970 and the early 1980’s we saw a gradual increase in the price of gold up to $700 per ounce in the early ’80s. We then saw a rapid descent in the price to approximately $300 per ounce in the space of two years. This equates to a 57% drop in value over the 2 year period. The price of gold chart shows that following this drop we experienced a prolonged period of reasonable stability in the price of gold fluctuating between $250 per ounce and $500 per ounce without any drastic shifts in the price. This would have meant a considerable drop in the value of gold holdings because inflation would have impacted the real value negatively. From 2005 we begin to see a rapid increase in the price of gold, up to over $1700 per ounce at the peak following the global financial crisis of 2007/08. This leaves the question of where gold will be moving next in the future.

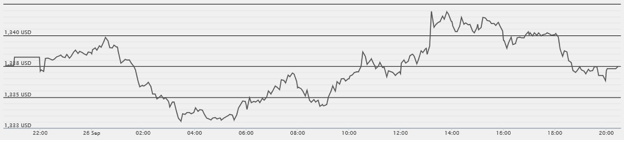

The following chart is a daily chart showing the price movements of gold over the course of the day. We can see that the price does not move in a constant and smooth direction throughout the day, which shows the constant change of buyers and sellers within the market. On websites where you examine the price of gold charts, you will be able to adapt the time frames to look as closely at specific time periods as you wish, to the point where you can see the price movements on a tick by tick basis. You would generally choose to look at a daily chart for the price of gold if you were wishing to buy and sell gold over a shorter period of time, in comparison to looking at the long term chart above. Many short term traders would use this time framed gold chart to predict movements in the price of gold by using technical analysis. Technical analysis is the practice of predicting future price movements by looking at past price movements as an indicator, under the impression that past patterns on the chart will persist in the future. People can access this information and it will be the same worldwide so someone looking for the gold price Indian market will access the same data as other local markets, but they can be converted into different currencies.

Now we have talked you through everything you need to know on how to buy gold, you are now ready to start purchasing and investing in gold. If you require further advice on purchasing gold bullion products, contact us today for assistance from our expert customer service team.

Now we have talked you through everything you need to know on how to buy gold, you are now ready to start purchasing and investing in gold. If you require further advice on purchasing gold bullion products, contact us today for assistance from our expert customer service team.

This information is used for informational purposes only, you are to make your own analysis before investing based on your personal circumstances and independent financial advice. This information does not constitute or recommend any transactions or investment strategies and are not personalised recommendations or personal views. It is only to be used for screening to narrow a search but not to substitute independent research. We will not be liable in any respect for damage, expense or loss that could arise as with every investment. Value of shares and investments can go up as well as down so investors may not get their money back and past performance is not to be used as a guide to future performance. This is not legally binding and should not be constituted as investment advice.