Gold Investment Awareness

In a landscape with plenty of investment choices, gold is a timeless asset with the potential for stability and growth. Yet, how well do people understand gold as an investment? To uncover this, the experts at The Gold Bullion have conducted a survey exploring public awareness and engagement with gold investments. We asked 2,000 people in the UK about their familiarity with gold opportunities, the types of gold items they’ve invested in, and their other investment ventures.

Over 65s are most aware of gold investment but are least likely to invest

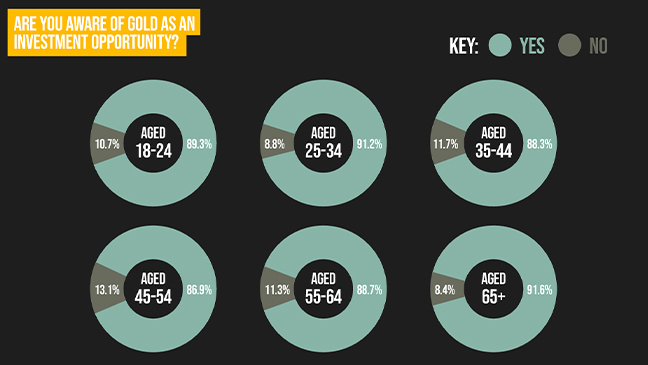

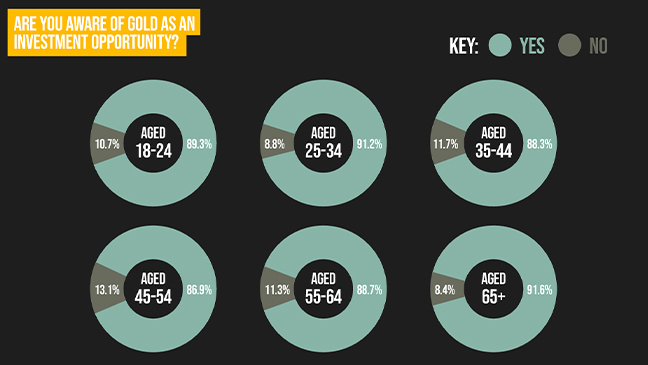

Across all age groups, awareness of gold investment is quite high, with figures ranging from 86.9% to 91.6%. The highest awareness comes from those aged 65 and over (91.6%), while people aged 45–54 have the lowest at 86.9%. Younger generations, like Gen-Z and Millennials, also show strong awareness, with around 90% knowing about gold as an investment.

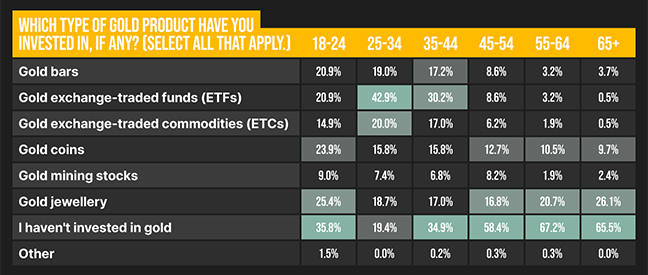

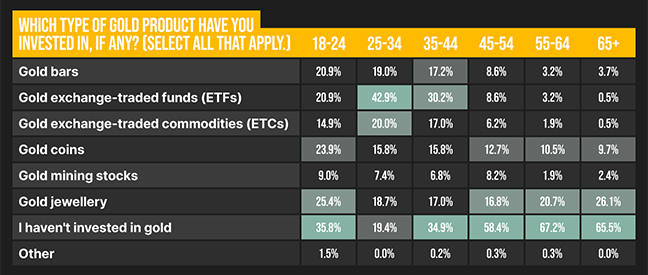

When it comes to actually investing in gold, Millennials stand out as the most active, especially with newer products like gold ETFs (42.9%) and gold bars (19.0%). In contrast, older generations, like Boomers, prefer traditional options like gold jewellery, with over one in five (20.7%) investing in this form.

Interestingly, while they are the most aware of gold investment, many older generations have yet to buy gold items, with two-thirds (65.5%) of those aged 65 and over not making any investments.

People in Bristol, Glasgow, and London are most aware of gold investment

.jpg)

Bristol, Glasgow, and London have the highest awareness levels, showing more than nine in 10 (92.5%) respondents know of gold as an investment opportunity. This high awareness in major cities like London and Glasgow could be linked to their status as financial hubs, where investment options are more widely discussed and promoted.

Even in cities with slightly lower awareness, such as Southampton (86.7%) and Manchester (88.2%), most respondents are still familiar with gold as an investment.

Norwich residents have the lowest overall awareness of gold investment, with a fifth (20.3%) of people answering no to the question.

Jewellery is the most common gold investment across the UK

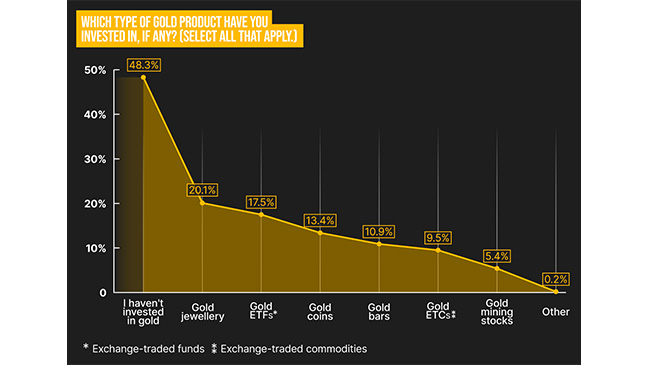

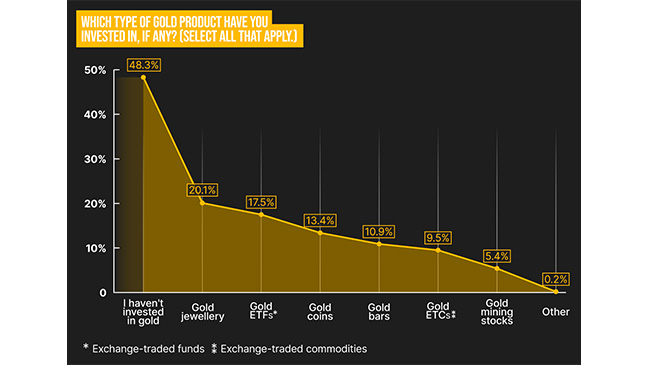

Nearly half of respondents (48.3%) haven’t invested in gold at all, showing that while awareness may be high, actual participation in gold investment is more limited. Gold jewellery is the most popular choice among those who invest, with 20.1% of people opting for this form of gold.

Gold exchange-traded funds (ETFs) are the second most popular option, with almost one in five (17.5%) respondents investing in them. This shows an interest in accessible gold investment forms that don’t require storing the precious metal.

Gold coins are the third-highest form of gold investment. Nearly one in six (13.4%) people have bought one previously.

Women are more likely than men to invest in gold exchange-traded funds (ETFs)

.jpg)

While nearly half of both genders haven’t invested in gold (47.4% for women, 49.3% for men), those who have, show distinct patterns.

Men are more likely to invest in physical gold products like gold bars (14.4%) and gold coins (17.3%), compared to 8.1% and 10.1% of women, respectively. Men are also more likely to invest in gold mining stocks, with 8.4% participation compared to 3.0% of women.

On the other hand, women tend to favour gold jewellery (21.3%) slightly more than men (18.8%) and are also more likely to invest in gold ETFs (19.9% vs. 14.6%).

People in Liverpool are least likely to invest in gold

.jpg)

London and Manchester stand out as cities with high participation in gold investment, especially in physical gold products. In Manchester, almost a third (31.2%) of people have invested in gold bars and 29.9% in gold coins, the highest among all cities. London follows with solid engagement in both ETFs (20.3%) and gold jewellery (22.5%).

In contrast, cities like Liverpool, Edinburgh, and Cardiff show much higher rates of people who haven't invested in gold, with over 60% in each location saying they haven't participated.

Jewellery is the most popular gold product in many cities, with Southampton (28.2%), Liverpool (26.3%), and Leeds (24.8%) leading in this category. This suggests that people in these areas prefer gold as a tangible asset with personal value.

Outside of gold, shares are the most popular investment

.jpg)

The data shows that a significant portion of respondents, nearly two in five (36.6%), haven’t made any investments outside of gold, indicating that many people are still hesitant or unsure about investing in other assets. Of those who invest, shares (28.4%) and stocks (18.9%) are the most popular choices, suggesting that traditional financial markets remain a primary focus for many investors.

Cryptocurrency has gained considerable traction, with over one in six (17.2%) people now investing in digital currencies, a relatively high number compared to other newer investment options like non-fungible tokens (8.2%).

Investment in shares is lowest amongst 18–24 and gradually increases with age

.jpg)

Some types of investments seem to be declining as time goes on. While investment in shares is at a respectable 34% among the over 65s, this steadily reduces among younger generations, with only 21.3% of Gen-Z investors choosing these.

Gen Z is interested in modern and speculative investments, with higher engagement in cryptocurrencies (17.3%) and NFTs (12.0%) than other opportunities such as mutual funds and precious metals outside of gold. They also show interest in real estate (22.7%) and stocks (26.7%), but a significant portion (29.3%) hasn’t made any investments yet.

Millennials balance high-risk and stable investments, leading in cryptocurrency (33.2%) and real estate (28.8%) while also investing in stocks and shares (21.5% each). They have lower non-investment rates (19.1%) than Gen Z, reflecting a higher level of investment activity.

People in Scotland are the most likely to invest in real estate, while people in Northern Ireland are most likely to buy cryptocurrency

.jpg)

Northern Ireland leads with a high investment in cryptocurrencies (36.4%) and has notable engagement in shares (18.2%) and real estate (12.1%), indicating an interest in both modern and traditional investments.

Real estate is also popular across other regions, peaking in Northern England (17.5%) and Scotland (16.9%).

Shares are one of the most-invested products in the UK, with high engagement rates across all regions. People in Scotland and South East England have the strongest interest in shares, with three in ten (32.3% and 30.5%, respectively) investing in them.

However, many respondents haven’t made any investments outside of gold yet. This is especially true in South West England (41.5% not investing) and Wales (42.3% not investing), suggesting a more cautious investment attitude.

Methodology

We surveyed 2,000 people from the UK on awareness of gold investment and participation in other types of investment. We asked the following questions. If respondents answered ‘No’ to question one, they skipped question two:

- Are you aware of gold as an investment opportunity? (2,000 UK respondents)

- Which type of gold product have you invested in, if any? (1,787 UK respondents)

- What other investments have you made, if any? (2,000 UK respondents)

The survey was conducted in September 2024 and is correct as of then.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)