Geopolitical tensions are heating up again in the Middle East, which could lead to higher gold and silver prices through 2024 according to market analysts.

On January 12th, the US and UK hit Houthi rebel targets in Yemen with airstrikes. This represents an escalation of the ongoing conflict in the region following Houthi attacks on shipping vessels in the Red Sea last October.

The military response from the West is likely to raise tensions and risks further disruptions to commerce through key shipping lanes. As a result, many experts believe gold and silver prices could steadily rise as investors seek safe haven assets.

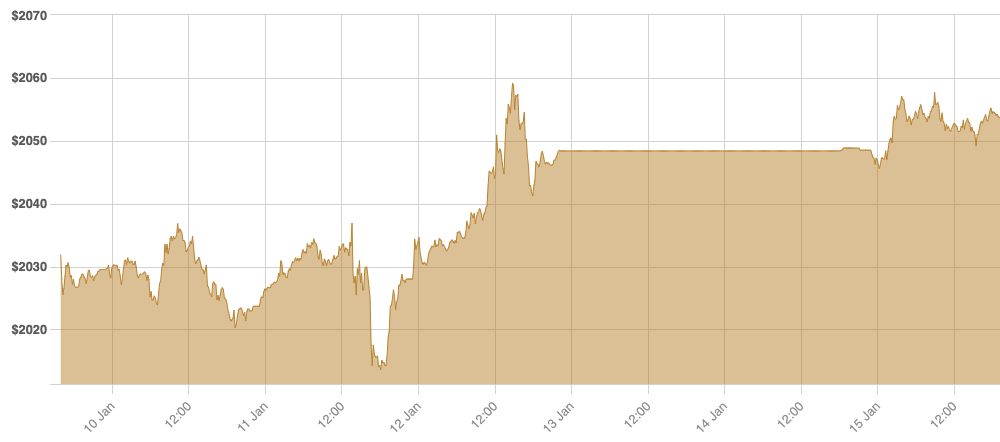

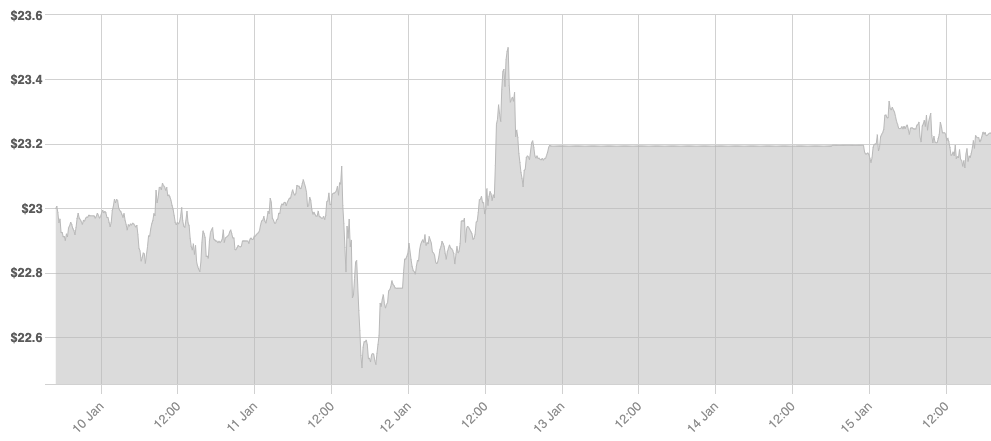

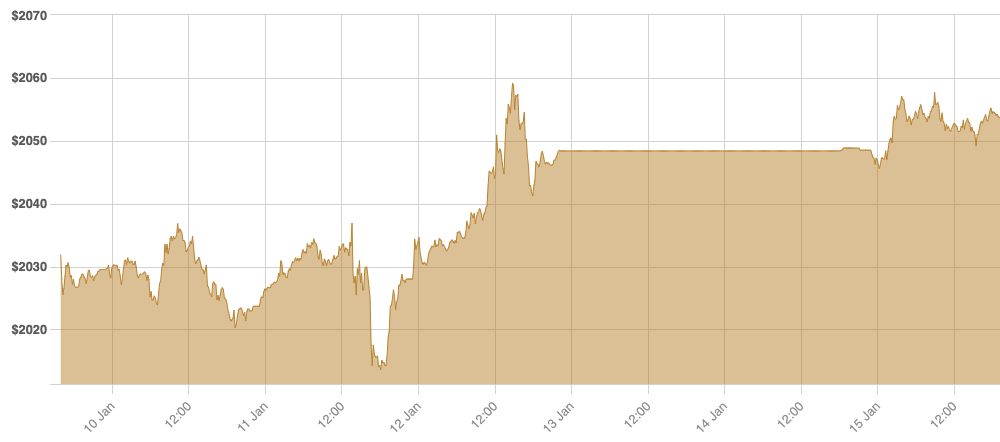

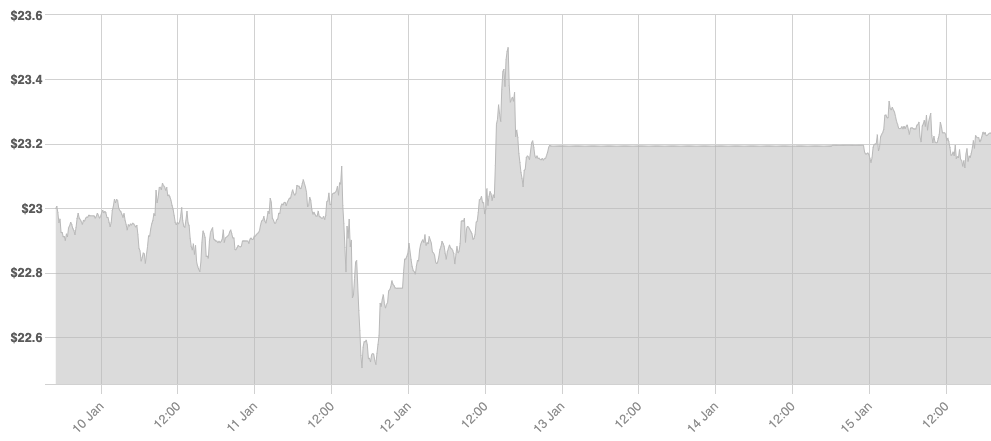

Both gold and silver had seen some short-term weakness last week, driven by a surging US dollar. Upward surprises in US inflation data and continued strength in the job market have reduced expectations for near-term interest rate cuts by the Federal Reserve. The likelihood of lower rates typically benefits non-yielding assets like precious metals.

From the lows earlier last week, gold has already recovered back to around $2,050 currently. Silver has bounced off two-month lows below $23, now trading just above $23/oz again.

Investors seem to have become less reactive amidst volatile global conditions in recent years. Nonetheless, most analysts expect buying interest in gold and silver to steadily increase on any substantial military action in the Middle East.

Of course, higher oil prices and prolonged supply chain disruptions stemming from the conflict would risk feeding further inflation. This could keep pressure on central banks to keep interest rates elevated, posing a headwind for gold and silver.

While macroeconomic factors may limit the upside, rising tensions in the Middle East appear likely to provide support for gold and silver prices as 2024 unfolds. Some predict gold pushing back above $2,100/oz which would signal a new bullish trend. As always geopolitics and market sentiment can shift rapidly, so investors should watch events closely.