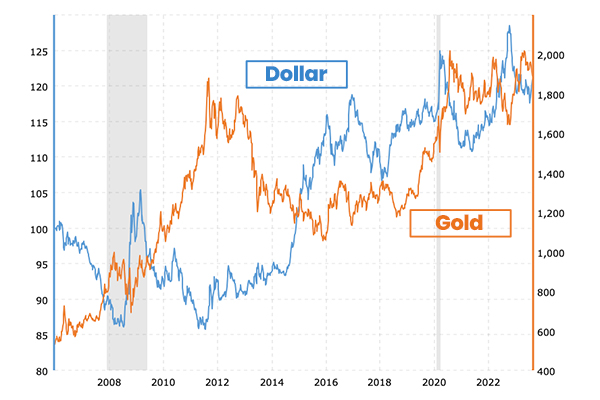

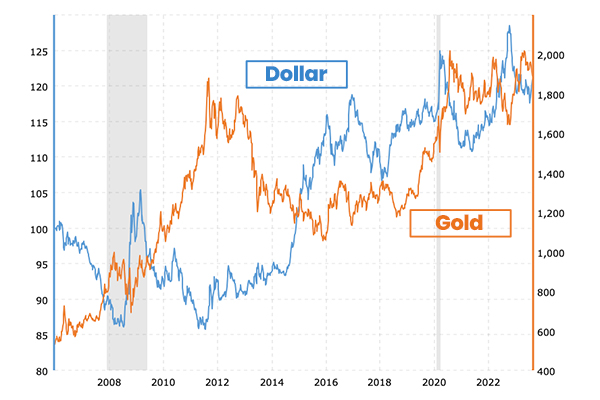

A Tale of Two Currencies - Gold vs. the Mighty Dollar

For thousands of years, gold has captivated humanity with its alluring shine and enduring value. In modern times, gold remains a go-to asset for hedging against uncertain economic waters. Yet despite gold's long history as a store of wealth, its price ebbs and flows with the fortunes of its chief rival - the US dollar. So what is the relationship between gold and the greenback? Read on to uncover the intriguing ties between these two heavyweights of finance.

Source

What Drives Fluctuations in the Gold Price?

Gold pricing is complex, influenced by an array of factors from mining output and central bank policies to investor sentiment and supply/demand dynamics. However, the key driver that explains much of gold's price volatility is its inverse relationship with the US dollar.

When the dollar strengthens against other major currencies, it makes dollar-priced commodities like gold more expensive for foreign buyers. This dampens demand and exerts downward pressure on gold's price. Conversely, a weaker dollar makes gold less expensive for foreign purchasers, boosting demand and lifting gold's price.

The US Dollar's Role as Global Reserve Currency

To understand gold and the US dollar's interplay, we must first recognise the dollar's status as the world's primary reserve currency. The dollar is used globally in international trade, central bank foreign exchange reserves, and pricing of key commodities like oil.

This grants the US outsized influence over the global financial system. It also means that dollar strength or weakness has ripple effects on the relative value and demand for commodities traded in dollars - our old friend gold included.

How Monetary Policy Impacts the Dollar and Gold

Another key linkage between the dollar and gold prices comes down to monetary policy set by the US Federal Reserve. Actions like interest rate hikes to curb inflation make the dollar more attractive for yield-seeking investors. Again this lifts the dollar's value, pressuring gold prices lower.

Conversely, loose monetary policy and rate cuts discourage dollar investment and contribute to dollar weakness. This environment fans demand for non-yielding assets like gold, sending its price higher.

Geopolitical and Economic Crises - A Boon for Gold

Though the interplay between dollar strength and gold is complex, one reliable relationship has stood the test of time. In periods of geopolitical tensions, market turmoil and economic crises that threaten the dollar's value, gold shines.

Its enduring role as a safe haven asset comes to the fore during such tumultuous times. Even better for gold bulls, economic crises also often precipitate loose Fed monetary policy and dollar weakness - a double bonus!

Should You Buy Gold Now?

With economic storm clouds gathering in 2023, is it time to stock up on physical gold as insurance for your investment portfolio? Here are some key questions to ask yourself:

- Do you have an adequate emergency cash fund first? Gold often shines brightest as a long-term hedge.

- Are you comfortable with gold's volatility? The gold price can swing rapidly at times.

- Will you hold gold for the long haul? It may test your patience before paying off.

If you can answer yes to these questions, then it may be the right time to make a precious metals purchase. Just be sure to work with a reputable dealer like The Gold Bullion Company to secure competitively priced and verified gold coins or bars.

Let Your Portfolio Shine with Gold

There's no doubt gold and the US dollar have a nuanced yet crucial relationship that heavily influences the gold price trend. But rather than be dazed by gold's volatility, savvy investors can harness this knowledge to time gold purchases wisely - buying when the dollar is weak, inflation looms and uncertainty spikes.

Done right, judiciously adding physical gold or gold-backed assets can diversify your holdings and add profitable shine to your investment portfolio when you need it most. So don't fear the ups and downs, and let gold lend your wealth lasting lustre for generations to come.

Ready to add physical precious metals from The Gold Bullion Company to hedge your portfolio? Click here to browse our selection of gold and silver coins and bars at competitive prices today.